Capital Solutions for European Companies

Corporate Solutions

Apollo provides long-term, scaled financing to advance Europe’s most strategic priorities. From energy transition and security to next-generation technology and critical infrastructure, the cost and form of our capital allows us to partner with the largest companies and governments to help capitalize ambitious growth plans.

We’ve deployed more than $50 billion in large-scale, high-grade financings for European assets and companies in the last several years alone and have approximately $150 billion of AUM in the region as of September 30, 2025.

Recent Commitments

- item 1

As of December 31, 2025

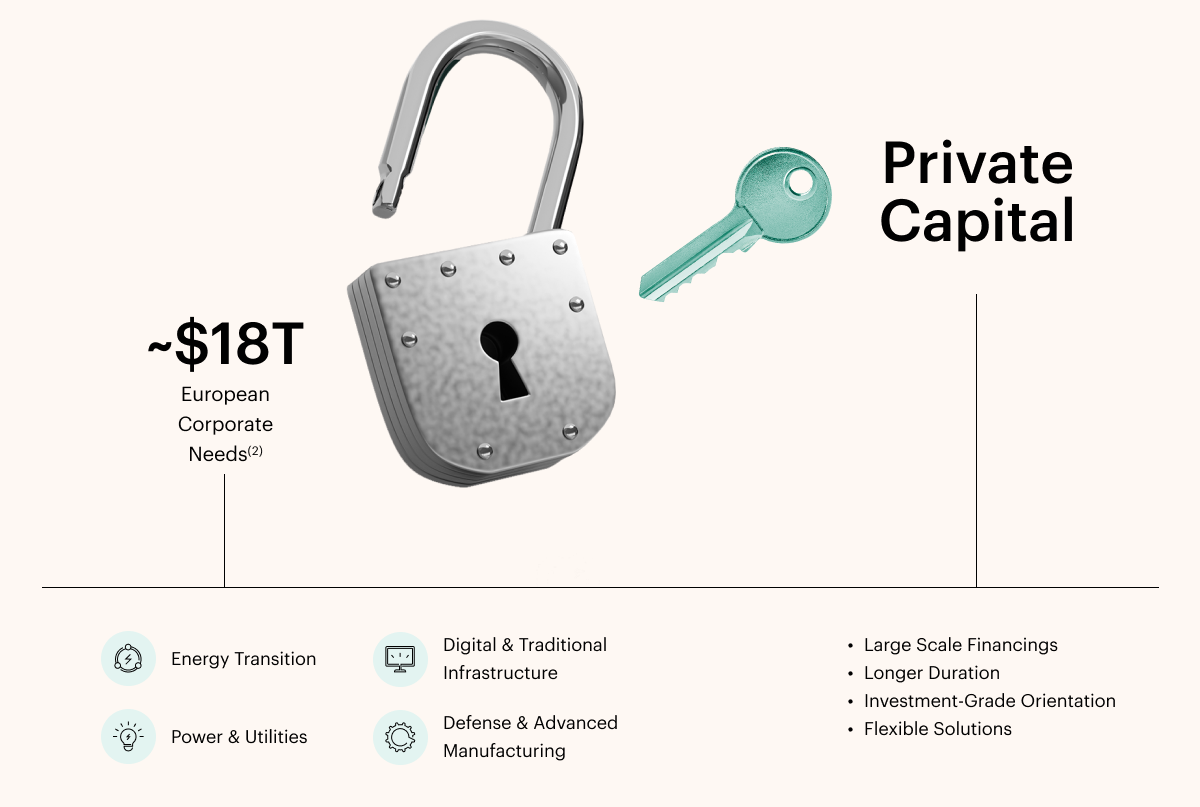

Market Needs

Why Private Capital?

Private credit doesn’t mean levered lending. At Apollo, we view private credit as a $40 trillion addressable market that is primarily investment grade.(3)

We invest in a wide range of asset classes across corporate credit and asset-backed finance, and we’re differentiated as a capital provider thanks to our retirement services balance sheets, which enable us to provide large-scale, long-duration, high-grade capital. Investment and structuring expertise means we can partner with borrowers on solutions that are tailored to their specific needs.

Insights

Case Studies

News & Announcements

Explore Our Strategies

Footnotes:

- Aggregate commitments across multiple transactions, in some cases over several years.

- Needs for nonfinancial corporates based on projected aggregate capital requirement over the next 10 years. Includes R&D and startup investment. Source: IEA, BloombergNEF, Statista, European Council, European Commission, Japan Cabinet Intelligence and Research Office, OECD, PitchBook, Peterson Foundation, UK Parliament, FRED, FRB. Estimate of Oliver Wyman.

- Represents the views and opinions of Apollo Analysts. Subject to change at any time and without notice.