Apollo Hybrid Value on the Launch, Growth and Sale of Blume Global

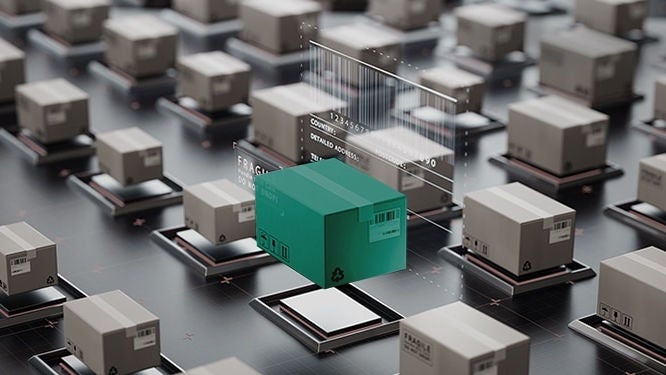

This past week, Apollo Funds completed the sale of Blume Global, a leading provider of digital supply chain execution and visibility solutions, to WiseTech Global in a transaction that represents a strategic expansion of the WiseTech portfolio and sets Blume on its next chapter of growth. Blume’s growth and success under Apollo Funds’ ownership highlights the creative approach in which Apollo’s Hybrid Value platform brings strategic value to portfolio companies.

Building Blume into a leading global supply chain technology platform, now part of WiseTech Global

This past week, Apollo Funds completed the sale of Blume Global, a leading provider of digital supply chain execution and visibility solutions, to WiseTech Global in a transaction that represents a strategic expansion of the WiseTech portfolio and sets Blume on its next chapter of growth.

Blume’s growth and success under Apollo Funds’ ownership highlights the creative approach in which Apollo’s Hybrid Value platform brings strategic value to portfolio companies.

Apollo’s history with Blume dates back to 2019 when Apollo Funds acquired DCLI, the largest chassis leasing provider in the US. DCLI was a well-established market leader with significant scale and a vast customer network, but the Apollo Hybrid Value team recognized that within it sat a much earlier stage technology unit. They opted to carve out and stand up Blume as an independent software company, under the leadership of technology and logistics executive Pervinder Johar.

The Apollo Funds capitalized Blume as a standalone business and provided strategic resources to management as Blume grew headcount, invested in significant R&D, and expanded its customer base. Working closely with Johar, the Apollo team, leveraging the Apollo Portfolio Performance Solutions (“APPS”) platform, advised on Blume’s cloud transformation efforts and refined the company’s product roadmap and go-to-market strategy, ultimately enhancing its overall customer value proposition.

Apollo Partner Justin Korval, Hybrid Value, explains: “Embedded within DCLI, we saw a rapidly growing technology asset that we believed could accelerate as an independent company. Over the course of our funds’ investment, Blume doubled its annual recurring revenue and signed up new major contracts with several blue-chip logistics customers, all while navigating COVID-19 and a complex macro landscape.”

In addition to supporting the business strategically, Apollo was focused on opportunistic transactions that would set Blume up for long-term success. In September 2021, Blume raised third-party equity capital from London-based Bridgepoint Group to help accelerate the company’s growth trajectory. Not long after, in December 2021, Blume completed the acquisition of LiveSource, a multi-enterprise supply chain business network, which strengthened Blume’s presence in the European market.

Blume’s success over the last few years ultimately drew the attention of Australia’s WiseTech Global, the developer of the leading logistics execution software CargoWise. WiseTech’s acquisition of Blume marks an attractive exit for the Apollo Funds and positions Blume for strong continued growth under new ownership.

Korval concluded: “Blume has made excellent progress deepening its global customer network and expanding into new geographies, while continuing to develop innovative solutions to meet the needs of the dynamic supply chain and logistics industry. We are proud to have supported Blume in its incredible growth and are excited to see where it goes next.”

Check out the official press release to learn more about Apollo Hybrid Value.

Tags