1. Apollo's 2024 Scope 3 reporting includes emissions from Fuel and Energy-Related Activities (Category 3), Waste Generated in Operations (Category 5) and expanded emissions from Purchased Goods and Services (Category 1).

2. As of December 31, 2024. Firmwide targets (the “Targets”) to deploy, commit, or arrange, commensurate with Apollo’s proprietary Climate and Transition Investment Framework (the "CTIF"), (1) $50B by 2027 and (2) more than $100B by 2030 toward clean energy and climate capital opportunities. The CTIF, which is subject to change at any time without notice, sets forth certain activities classified by Apollo as sustainable economic activities ("SEAs"), and the methodologies used to calculate contribution towards the Targets. Only investments determined to be currently contributing to a SEA in accordance with the CTIF are counted toward the Targets. Under the CTIF, Apollo uses different calculation methodologies for different types of investments in equity, debt and real estate. For additional details on the CTIF, please refer to our website here: https://www.apollo.com/strategies/asset-management/real-assets/sustainable-investing-platform

3. AAM and Athene calculated volunteer hours as separate entities. AAM employees volunteered 11,900 hours, and Athene employees volunteered 8,500 hours.

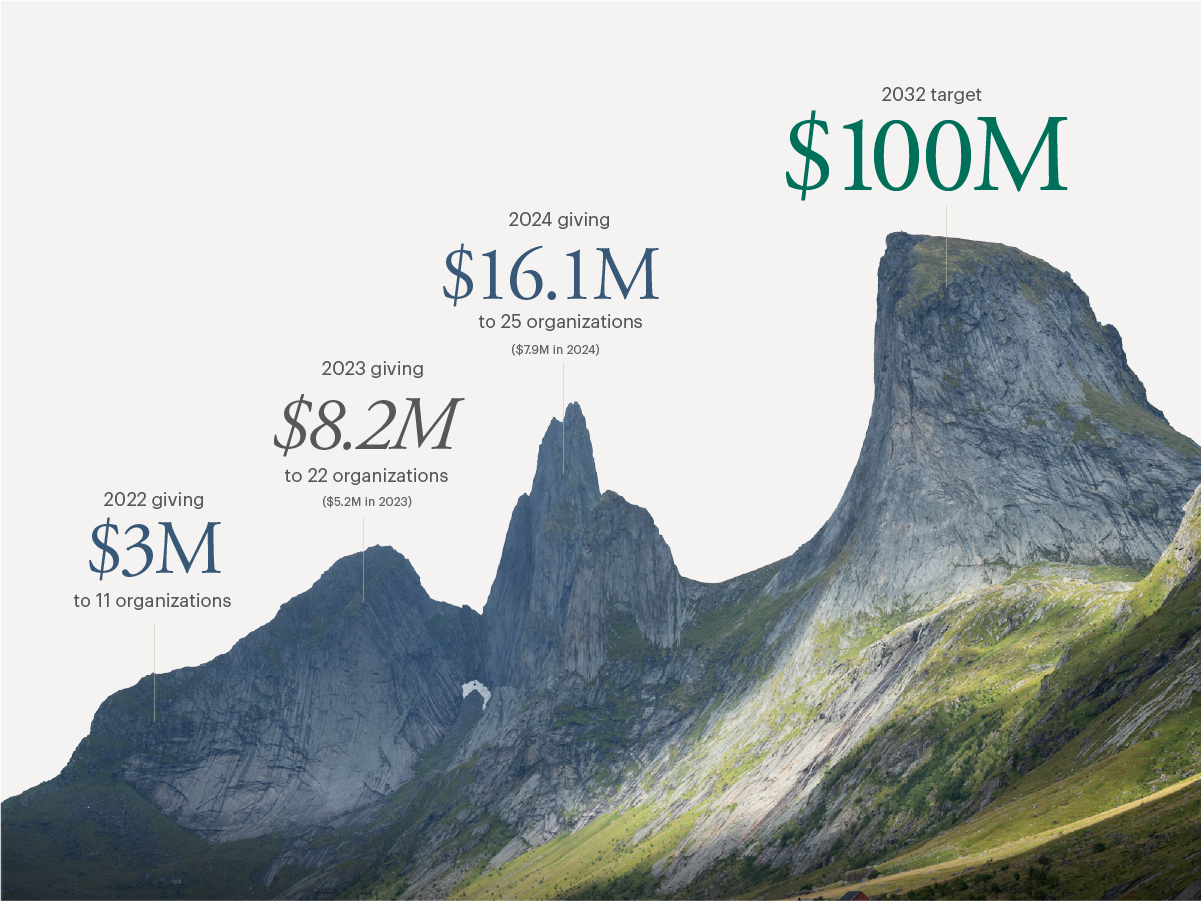

4. Amount includes employee donations and Athene match.2. Amount spread over the next five years.