Dave Stangis

Chief Sustainability

Officer

Driving a More Sustainable Future

The Apollo Sustainability Ecosystem

At Apollo, we work every day to lead responsibly and leverage our full platform to create positive impact. Since formalizing our ESG engagement and reporting program in 2009 we have engaged with hundreds of portfolio companies through reporting, site visits, and conferences to help drive sustainability, climate action, employee engagement, and responsible citizenship across these organizations.

Today, our commitment to sustainability remains a defining attribute of our firm and is embedded in our culture. We strive to be an industry leader in ESG data collection, transparency and engagement with portfolio companies, borrowers, counterparties and fellow industry participants.

Our Approach to Sustainability

Apollo has developed a strong bench of Sustainability talent, including our Chief Sustainability Officer, Dave Stangis, as well as dedicated heads of ESG for our private equity and credit businesses. The depth of talent and leadership reinforces Apollo’s commitment to sustainability as we look to drive operational rigor and positive impact around the globe.

That is why we are elevating our approach to sustainability further, leveraging it as a growth strategy for Apollo and our clients. By using sustainability as a driver of opportunity, we believe it can help the businesses in which Apollo-managed funds invest become better companies through engagement initiatives and empowering every employee to make a difference.

Sustainability Ecosystem

Sustainability Leadership

Laurie Medley

Global Head of ESG

Michael Kashani

Head of ESG, Credit

Joanna Reiss

Co-Head of Impact

Robert Esposito

Senior Counsel, Sustainability

Patience Ball

Impact Chair

Carletta Ooton

Head of ESG, Private

Equity

Christine Bave

Deputy Head of Sustainable Finance

Daniel Vogel

Deputy Head of

Sustainable Finance

Olivia Wassenaar

Head of Sustainability and Infrastructure

Jonathan Simon

Global Head of Leadership Development and Diversity

Joe Moroney

Head of Sustainable Finance, Co-Head of

Global Corporate Credit

Lauren Coape-Arnold

Global Head of Citizenship and Executive Director of the Apollo Opportunity Foundation

Recent Sustainability Achievements

Sustainable Investing Platform

In 2022, Apollo launched a comprehensive Sustainable Investing Platform focused on financing and investing in the energy transition and decarbonization of industry.

Apollo Impact Mission

The Apollo Impact Mission strategy pursues private equity opportunities that seek to generate positive, measurable social and/or environmental impact at scale while delivering attractive risk-adjusted returns. We adhere to a rigorous impact investment strategy that targets investments centered around two critical objectives – helping people and healing the planet.

Apollo is driving an evolution in the impact investing landscape by applying the strategy to the mid-market, investing in later-stage, mature companies. We employ the “classic Apollo” value-oriented lens and harness the full power of the firm as we seek to drive both financial success and impact at AIM portfolio companies.

APOLLO IMPACT OBJECTIVES

Driving Sustainability Across Our Ecosystems

We are committed to responsible leadership and believe that driving sustainability best practices across our investment ecosystems helps to yield better business outcomes for all our stakeholders.

Sustainability Insights

Read timely insights from across Apollo’s Sustainability ecosystem.

- container

More Information

1. As of December 31, 2023. Deployment commensurate with Apollo’s proprietary Climate and Transition Investment Framework, which provides guidelines and metrics with respect to the definition of a climate or transition investment. Reflects (a) for equity investments: (i) total enterprise value at time of signed commitment for initial equity commitments; (ii) additional capital contributions from Apollo funds and co-invest vehicles for follow-on equity investments; and (iii) contractual commitments of Apollo funds and co-invest vehicles at the time of initial commitment for preferred equity investments; (b) for debt investments: (i) total facility size for Apollo originated debt, warehouse facilities, or fund financings; (ii) purchase price on the settlement date for private non-traded debt; (iii) increases in maximum exposure on a period-over-period basis for publicly-traded debt; (iv) total capital organized on the settlement date for syndicated debt; and (v) contractual commitments of Apollo funds and co-invest vehicles as of the closing date for real estate debt; (c) for SPACs, the total sponsor equity and capital organized as of the respective announcement dates; (d) for platform acquisitions, the purchase price on the signed commitment date; and (e) for platform originations, the gross origination value on the origination date. Amount spread over the next five years.

Highlights:

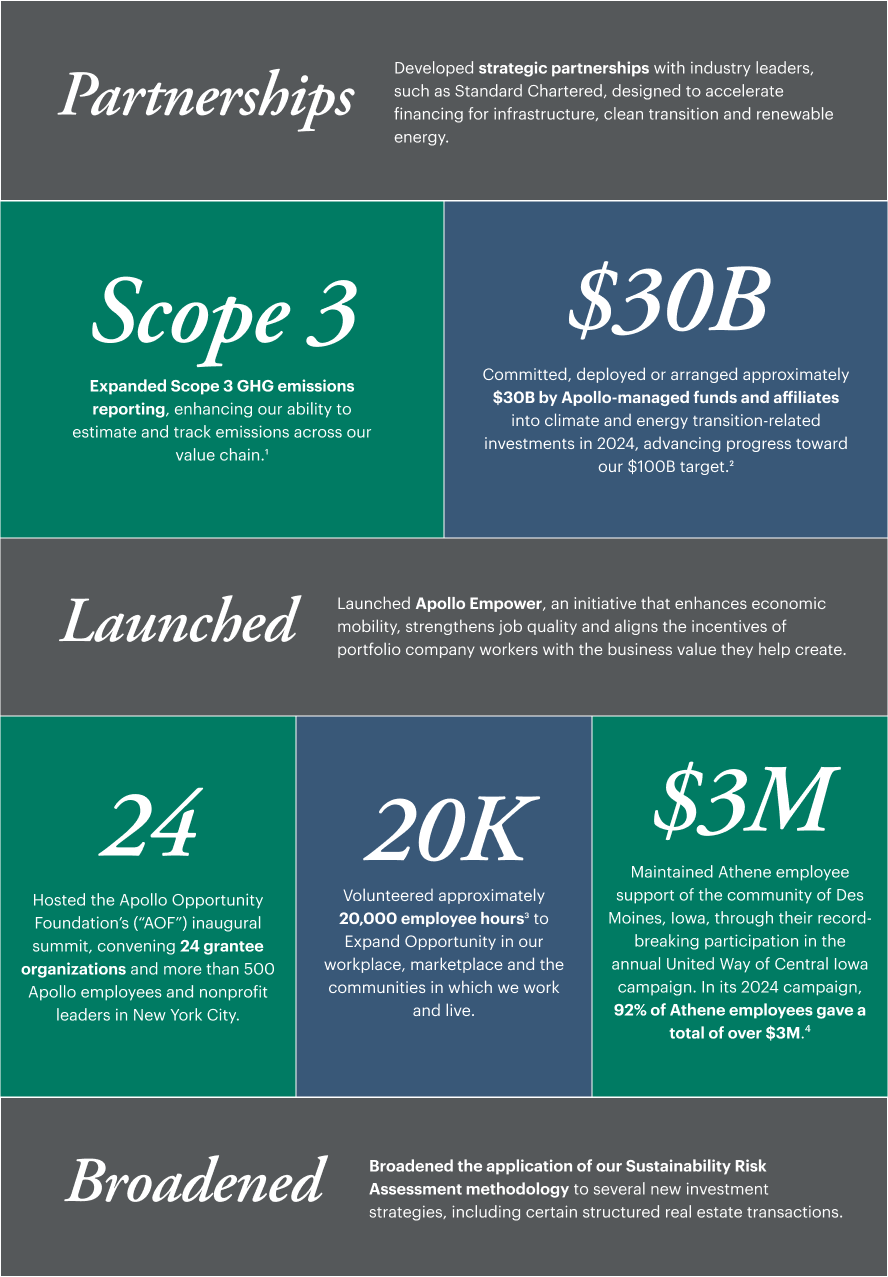

1. Apollo's 2024 Scope 3 reporting includes emissions from Fuel and Energy-Related Activities (Category 3), Waste Generated in Operations (Category 5) and expanded emissions from Purchased Goods and Services (Category 1).

2. As of December 31, 2024. Firmwide targets (the “Targets”) to deploy, commit, or arrange, commensurate with Apollo’s proprietary Climate and Transition Investment Framework (the "CTIF"), (1) $50B by 2027 and (2) more than $100B by 2030 toward clean energy and climate capital opportunities. The CTIF, which is subject to change at any time without notice, sets forth certain activities classified by Apollo as sustainable economic activities ("SEAs"), and the methodologies used to calculate contribution towards the Targets. Only investments determined to be currently contributing to a SEA in accordance with the CTIF are counted toward the Targets. Under the CTIF, Apollo uses different calculation methodologies for different types of investments in equity, debt and real estate. For additional details on the CTIF, please refer to our website here: https://www.apollo.com/strategies/asset-management/real-assets/sustainable-investing-platform

3. AAM and Athene calculated volunteer hours as separate entities. AAM employees volunteered 11,900 hours, and Athene employees volunteered 8,500 hours.

4. Amount includes employee donations and Athene match.2. Amount spread over the next five years.